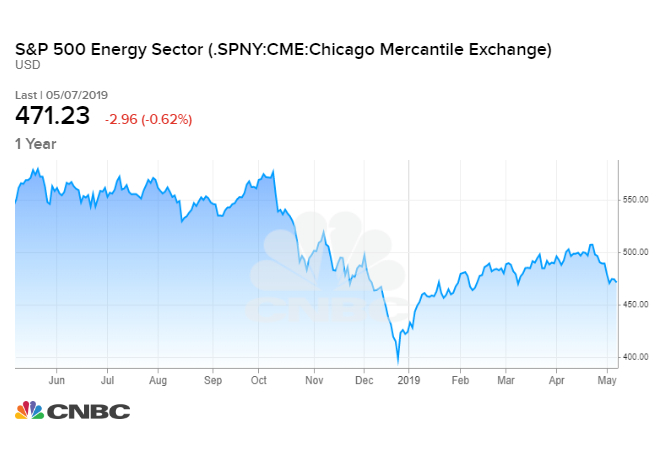

Energy stocks are on the cusp of a bear market as trade war heats up

[ad_1]

A drilling crew member on an oil rig in the Permian Basin near Wink, Texas.

Nick Oxford | Reuters

Energy stocks are on the cusp of falling into a bear market after a sudden escalation in the U.S.-China trade dispute dragged the stock market lower on Tuesday.

The S&P 500 energy sector finished the day down 18.7% below its 52-week high. It was the only sector to end the day in correction territory, meaning it closed 10% or more below its 52-week high.

Tuesday’s slump highlights the energy sector’s continued struggle to break out amid uncertainty around future oil prices and global demand for crude. The energy sector is up 11% this year, outperforming utilities, materials and health care but trailing high fliers like technology and consumer discretionary stocks by a wide margin.

President Donald Trump this week threatened to raise tariffs on Chinese goods on Friday. The move came after China backtracked on virtually all of the major parts of a trade pact being negotiated with Washington, Reuters reported on Wednesday.

The prospect that the world’s two largest economies will not resolve their trade dispute is a particular concern for the energy space. Higher tariffs are seen weighing on global economic growth, which could dent demand for energy supplies like oil and natural gas.

The trade tension exacerbates the uncertainty that has plagued the oil market since an historic price crash in 2014.

Wild oil prices swings last year kept many investors on the sidelines. The volatility made it difficult to predict the fortunes of oil companies, so the energy sector remained stuck in a game of wait-and-see.

The path of oil prices became more certain this year, with benchmark crude oil futures rallying more than 40%. But the rally has faltered as the U.S.-China trade dispute threatens to derail global growth and traders brace themselves for higher output from Saudi Arabia and OPEC.

U.S. crude has fallen as much as 10% from its 2019 high over the last two weeks. International benchmark Brent crude was down about 8% from its 2019 high on Wednesday.

WATCH: Iran sanctions, Venezuela turmoil tighten oil market balance

Source link