Investors place bets on Permian drillers after Chevron-Anadarko deal

[ad_1]

Paul Sankey, oil equity analyst at Mizuho Securities, said that makes sense. He believes future consolidation will be driven by efforts to more efficiently develop Permian acreage.

Drillers can do that by stringing together big strips of land that make it more cost-effective to execute the advanced drilling methods necessary to extract oil from shale rock formations. Following the deal, Chevron boasted that the combined company would have a 75-mile-wide corridor in a sweet spot of the Permian.

“As a consequence, expect focus to be on complementary acreage position, which helps explain the recent performance of the Permian pure-plays following the CVX-APC news — a single basin operator seems a lot simpler to integrate into an existing position,” Sankey said in research note Wednesday.

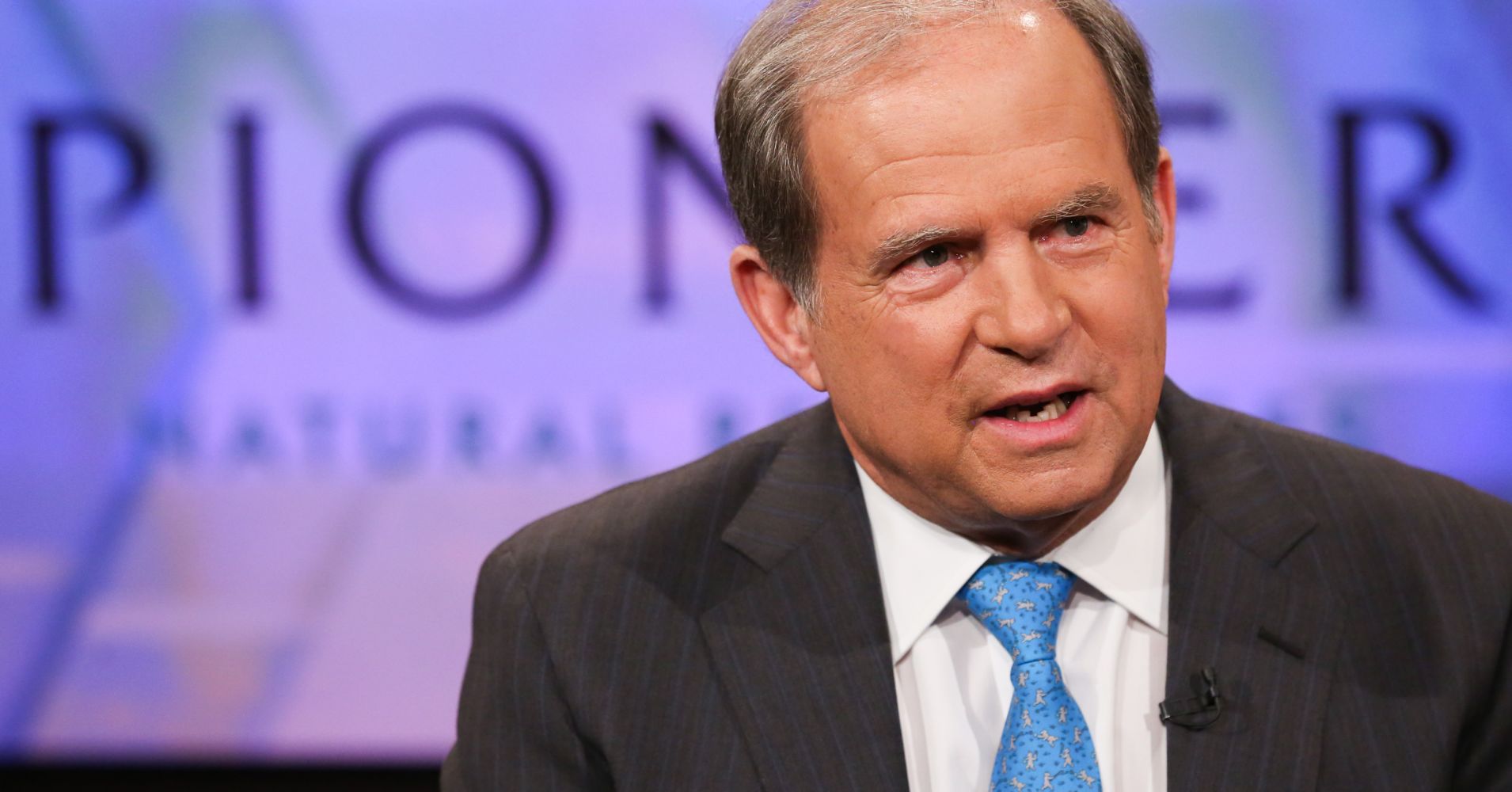

CNBC’s Jim Cramer thinks that the company most likely to get a bid is Pioneer Natural Resources, a driller led by Scott Sheffield that recently shed assets to become a pure-play Permian producer.

“That’s the one that I think gives you very good Permian. Scott is a very shareholder-conscious gentleman,” Cramer said Monday. He noted that Pioneer’s $29 billion market capitalization is in the ballpark of Anadarko’s stock market valuation.

Source link