Oil market is facing a ‘triple whammy’ of pressures

[ad_1]

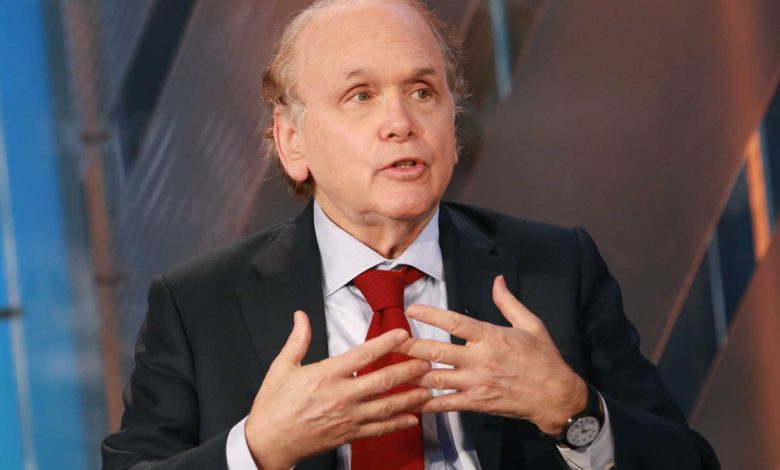

Oil expert Daniel Yergin told CNBC on Monday that the industry is facing “a triple whammy” of pressures, contributing to the tumult facing global markets.

“You have oil, you have geopolitics, and you have the virus,” the Pulitzer Prize-winning author said on “The Exchange.”

The situation at hand for oil producers has become “a battle for market share in a constricting market,” he said.

Yergin’s comments came as oil prices sank to multiyear lows following an escalation of tensions between Saudi Arabia and Russia.

OPEC was unable to reach an agreement with its allies last week on production cuts, with Russia reportedly spearheading the opposition. Saudi Arabia responded by reducing its oil prices while it reportedly plans to increase its own production.

But Yergin called attention to one of the reasons the potential production cut was being discussed: the fast-spreading coronavirus.

The disease, which originated in China but has since spread across the globe, has dramatically reduced the demand for oil as business activity and other consumer behavior such as travel have been curtailed.

“It starts with the virus,” said Yergin, vice chairman of IHS Markit. “In the first quarter, we estimate that oil demand compared to last year was down almost 4 million barrels a day.”

And in the U.S. and Europe, where cases of the coronavirus have been escalating lately, the demand for oil is going to drop further before it gets better, he said.

While demand for oil may not fall significantly in Europe and North America as it did in China, Yergin said, “This means that this market is going to be very difficult and countries are not going to be able to make up on volume what they lose on price.”

U.S. West Texas Intermediate crude declined 24.59%, or $10.15, to end Monday at $31.13 per barrel. WTI was at more than $60 per barrel in early January.

Brent crude, the international benchmark, fell by 21.3% on Monday to end the session at $35.58 per barrel.

The low cost per barrel is causing concern over the fate of oil companies, many of which have sizable debt burdens that become more difficult to repay at current price levels.

Yergin, author of “The Prize: The Epic Quest For Oil, Money & Power,” said he thought the leadership at U.S. oil companies over the weekend “spent their time looking at their budgets, slowing down activity, stopping activity.”

“We’ll see bankruptcies. We’re going to see some people gasping for oxygen really trying to survive,” he said. “This is a very difficult, bracing period for those companies.”

But ultimately, Yergin said, “I don’t think this can last very long because it’s going to hit everybody’s finances including that of the countries,” referring in particular to Saudi Arabia and Russia.

“The impact is going to continue until there is some resolution here and a recognition that a battle for market share in a constricting market is not going to get you more money,” he said.

Source link