Trump’s Iran crackdown leaves oil market vulnerable to price spikes

[ad_1]

In the Trump administration’s telling, its decision to cut off Iran’s oil exports in just over a week will have little impact on crude prices. There’s enough supply to meet global demand, officials say, and the administration’s Middle East allies will ride to the rescue if the world does find itself short of fuel.

But outside the Oval Office, the outlook is not so rosy.

Analysts say President Donald Trump‘s hardline approach injects new risks into a fragile market besieged by instability in key oil-producing nations. They say global crude supplies are already getting tight, and Trump’s surprise crackdown will leave the market with little cushion to address future disruptions.

“Oil production is being curtailed at a time when Venezuelan output is rapidly falling, conflict in Libya is reviving, and OPEC spare capacity remains tight. This could nudge the oil market dangerously close to a negative supply shock,” Montreal-based macro research firm BCA Research said on Monday.

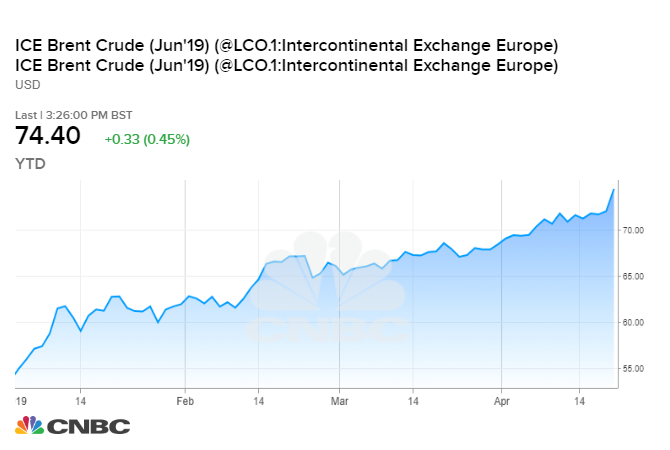

Oil prices surged to nearly six-month highs after the Trump administration said it will not extend sanctions waivers for several of Iran’s biggest oil customers. The exemptions allowed a handful of countries — including China and India — to import limited shipments of Iranian crude without triggering U.S. sanctions on Iran.

The move aims to shrink Iran’s oil shipments from roughly 1 million barrels per day to zero, though analysts expect some countries to defy the ultimatum.

Still, investment banks now expect Iranian shipments to fall by another several hundred thousand barrels per day, further tightening the market. This comes as Venezuela’s output craters under the weight of economic crisis and U.S. sanctions and a fresh round of deadly civil conflict rocks Libya.

The Trump administration says Saudi Arabia and the United Arab Emirates have agreed to fill the gap left by the Iranian barrels.

That suggests the OPEC members will soon hike production, reversing output cuts they implemented in January. OPEC and its oil market allies, including Russia, have been keeping about 1.2 million bpd off the market following a collapse in oil prices last year.

Saudi Arabia is already pumping about 500,000 bpd below its quota, giving the kingdom leeway to put more barrels on the market as shipments from Iran sink.

Source link