Why oil and gasoline prices are rising faster than analysts expected

[ad_1]

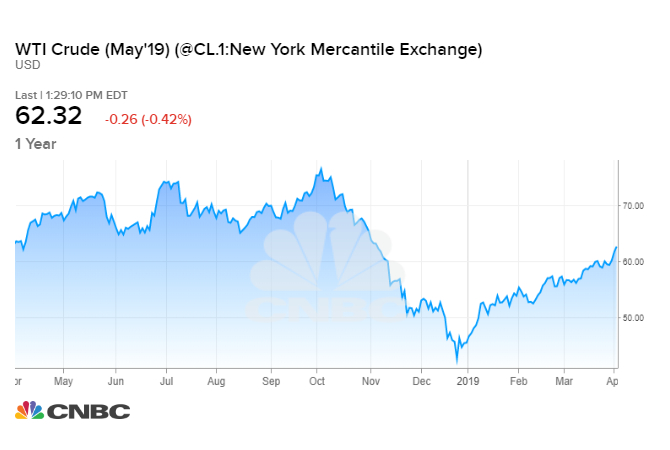

Oil prices are rising faster this year than many energy analysts expected, leaving many consumers to wonder how much further their gasoline bills will jump.

U.S. West Texas Intermediate crude oil prices have rallied 37 percent this year, hitting a five-month high near $63 a barrel on Wednesday. Brent crude, the international benchmark for oil prices, is up 28 percent and almost breached $70 a barrel for the first time since November.

The oil prices rally has contributed to seven straight weeks of higher U.S. gasoline prices. The national average for a gallon of regular gasoline is now sitting around $2.70.

“There’s no fooling motorists, gas prices have continued to surge,” said Patrick DeHaan, head of petroleum analysis for GasBuddy.com.

“The run-up this spring has felt worse than prior years, and thus far, the national average is up nearly 50 cents per gallon from our 2019 low. Unfortunately, this [is] a rut we’ll be stuck in yet for at least a few more weeks,” DeHaan said in an email briefing on Monday.

One reason oil prices have surprised analysts this year: Demand for crude has been stronger than gloomy forecasts suggested last fall. Those projections said growth in oil consumption would slow significantly, but the world’s appetite is growing at a healthy pace so far this year.

“Everybody came into the year with a very negative view and actually demand has been resilient,” Michele della Vigna, co-head of European equity research at Goldman Sachs said on Wednesday.

“Demand remains robust particularly in the emerging markets, which continue to buy a lot of crude,” he told CNBC’s “Squawk Box” in Europe.

Source link