Woodside, ENN in Scarborough field gas supply agreement

[ad_1]

Woodside has signed heads of agreement (HOA) with ENN Group for the sale of 1.0 million tonnes of LNG per annum from Woodside’s portfolio for a period of 10 years, starting in 2025, sourced from the Scarborough offshore gas field in Australia.

Woodside CEO Peter Coleman said the HOA, signed at LNG2019 in Shanghai, builds on an October 2018 cooperation agreement, under which the two companies committed to work together to explore a broad range of potential business opportunities.

“This HOA demonstrates market support for Woodside’s proposals to expand the Pluto LNG facility and develop the Scarborough offshore gas resource as part of our vision for the Burrup Hub in Western Australia,” he said.

Woodside and ENN have built a strategic partnership as both companies pursue growth phases, Woodside said. ENN is aiming to grow its market share in China’s gas distribution and retailing sector, as well as internationally.

On Thursday, April 4, ENN CEO Zhang Yesheng delivered a keynote speech at LNG2019 forum in Shanghai. He said:”The fast growing LNG demand in China is consistently driven by the ‘coal to gas’ policy, the requirement for quality industrial development and the call for actions to protect blue sky, clear water and clean soil,” he said. “For a long period of time in the future, China will be the market with the highest LNG growth in the world.”

HOA dependent on Scarborough FID

The HOA between Woodside and ENN remains conditional upon the negotiation and execution of a fully termed sales and purchase agreement and obtaining all necessary approvals and a Final Investment Decision on Scarborough project.

Woodside took over operatorship over the Scarborough project off W. Australia from ExxonMobil in 2018. Woodside paid $444 million for Exxon’s share and will pay $300 million following a positive final investment decision to develop the Scarborough field. The FID, according to the previously disclosed information, is expected to be made in 2020.

The Scarborough area contains the Scarborough, Thebe and Jupiter gas fields, which are estimated to contain gross (100%) contingent resources (2C) of 9.2 Tcf of dry gas.

Scarborough, discovered in 1979, is located off the coast of Western Australia approximately 220 kilometers northwest of Exmouth in 900 meters of water. It is one of the most remote of the Carnarvon Basin gas resources. Woodside first bought a stake there in 2016 from BHP Billiton.

Woodside last January awarded four contracts for front-end engineering design activities for the project to McDermott, Subsea Integration Alliance, Saipem, and Intecsea. Come February and McDermott signed a contract with Woodside to undertake a front-end engineering and design activities for a floating production unit (FPU) for the Scarborough field gas development.

Woodside’s preferred concept for development of the 7.3 Tcf (2C 100%) Scarborough gas resource (Woodside 75%) is through new offshore facilities connected by an approximately 430 km export pipeline to the Burrup Peninsula with onshore processing at the expanded Pluto LNG facility.

It is also worth reminding that Woodside has already found a buyer for a portion of natural gas to be produced from its Scarborough field, one of the most remote of the Carnarvon Basin gas resources. Namely, Woodside in November 2018 entered into a long-term gas sale and purchase agreement (GSPA) with W. Australia-based Perdaman for the supply of pipeline gas for a term of 20 years.

Shift from FLNG to Onshore

Six years ago in 2013, Exxon and BHP Billiton, then the sole partners in the Scarborough area, had received the environmental approval for the Scarborough field development via what was to be the world’s largest FLNG facility. The FID had been slated for 2014-2015, but the collapse in oil prices then forced the partners to pull the breaks on the project.

The FLNG options are now off the table, as Woodside has said shifted focus towards its existing onshore infrastructure – Burrup Hub – for the development of the Scarborough area.

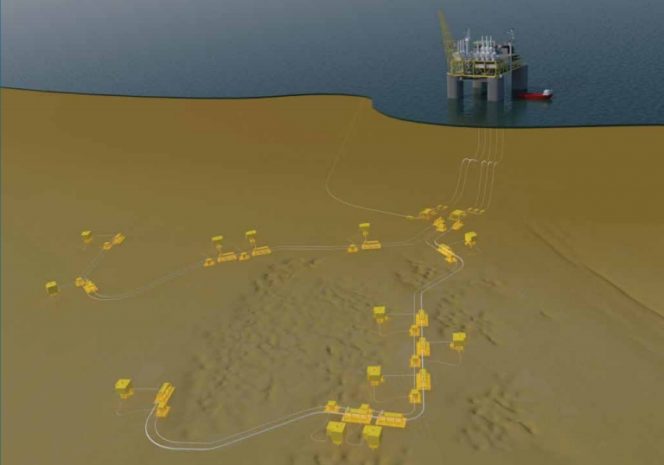

Woodside is proposing to develop the Scarborough resource with 12 subsea, high-rate gas wells tied back to a semi-submersible platform moored in 900 m of water.

The ~20,000 t topsides will have processing facilities for gas dehydration and compression to transport the gas through a ~400 km pipeline to the Woodside-operated Pluto LNG facility. The cost for the development is estimated at $8.5 – $9.7 billion.

The first production from the development is expected in 2025, to meet what Woodside expects to be a global LNG supply gap.

Offshore Energy Today Staff

Spotted a typo? Have something more to add to the story? Maybe a nice photo? Contact our editorial team via email.

Offshore Energy Today, established in 2010, is read by over 10,000 industry professionals daily. We had nearly 9 million page views in 2018, with 2.4 million new users. This makes us one of the world’s most attractive online platforms in the space of offshore oil and gas and allows our partners to get maximum exposure for their online campaigns.

If you’re interested in showcasing your company, product or technology on Offshore Energy Today contact our marketing manager Mirza Duran for advertising options.

Source link